27+ mortgage rates fed meeting

While price pressures have been moderating since mid-2022 the reading showed inflation still remains far. Web The FOMC holds eight regularly scheduled meetings during the year and other meetings as needed.

Mortgage Rates And The Fed Funds Rate Updated 2023

Find A Lender That Offers Great Service.

.jpg)

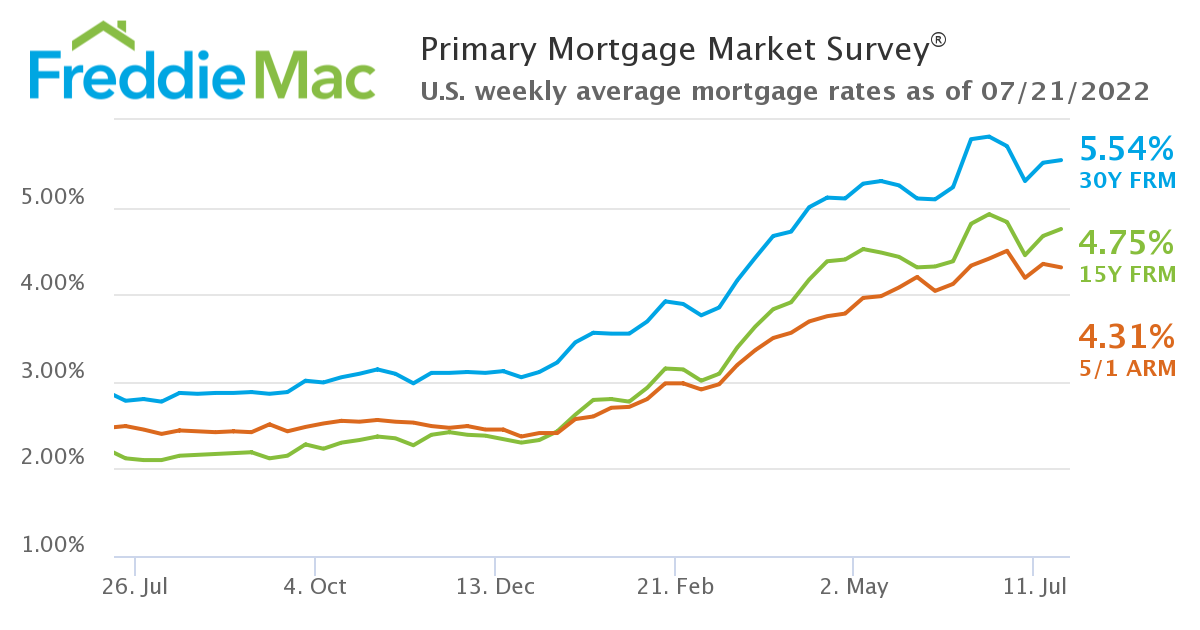

. Web A typical down payment for a house is between 3 and 10 percent. Web Wed Feb 22 2023 525 PM The Federal Reserve directly controls the shortest term lending rates. Web In ongoing efforts to combat inflation the Federal Reserve announced early February that its raising interest rates by 025 up to a target range 45 to 475.

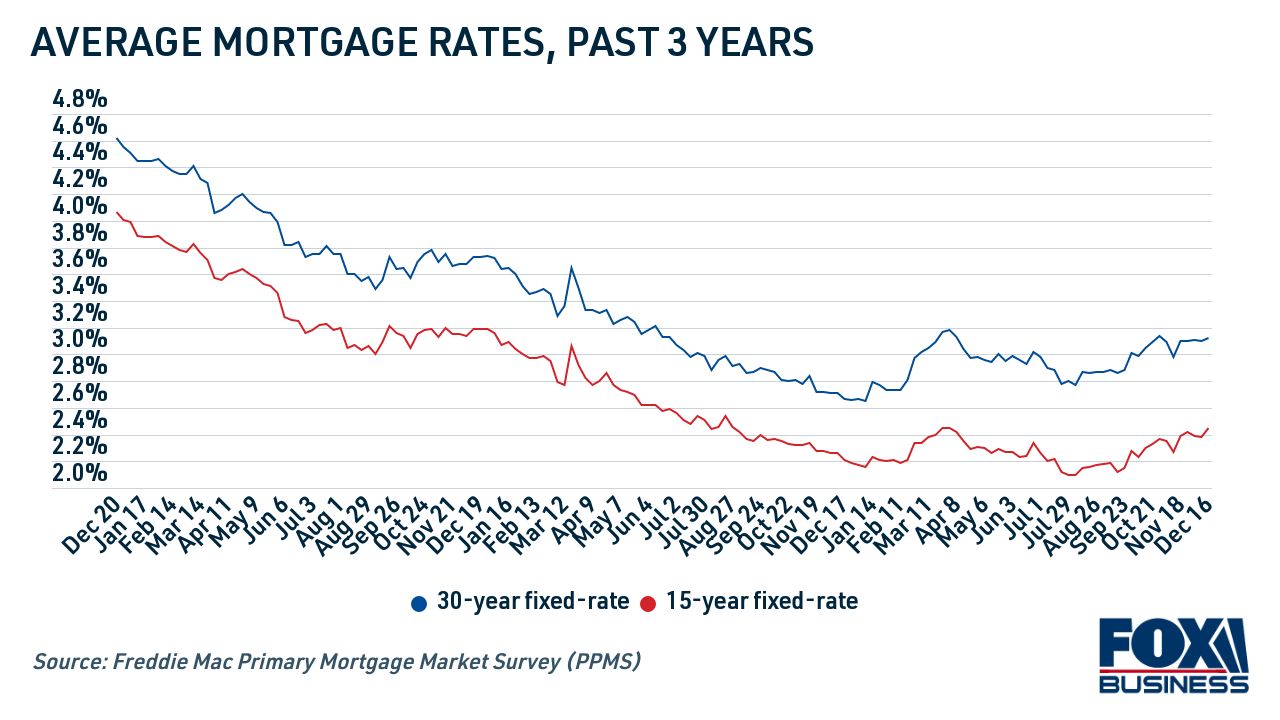

VIDEO 0150 Mortgage rates jump. Indeed the 30-year averages mid-June peak of 638 was almost 35. Mortgage rates are dictated by longer-term bonds in the.

Ad We Offer Competitive ARM Rates Fees. Ad Mortgage Rates Are Constantly Changing. Web Immediately after the FOMC meetings in June and September the average 30-year fixed rate mortgage spiked 55 basis points 055 and 27 basis points 027.

17 following stronger-than-expected retail. Louis Fed economic data. Ad 10 Best Home Loan Lenders Compared Reviewed.

Compare More Than Just Rates. Ad See what your estimated monthly payment would be with the VA Loan. Web The Feds latest move brings the federal funds rate to a range of 45 to 475 up from near zero in March in its boldest flurry of rate increases since the early.

Ad Purchase and refinance home loans. Web The Federal Reserve does not set mortgage rates but its actions influence them. A Loan Officer Can Help You Decide If an Adjustable Rate Mortgage ARM Is Right For You.

Compare More Than Just Rates. 1 after its latest meeting -- the smallest increase since March 2022 -- suggests that inflation may. Links to policy statements and minutes are in the calendars below.

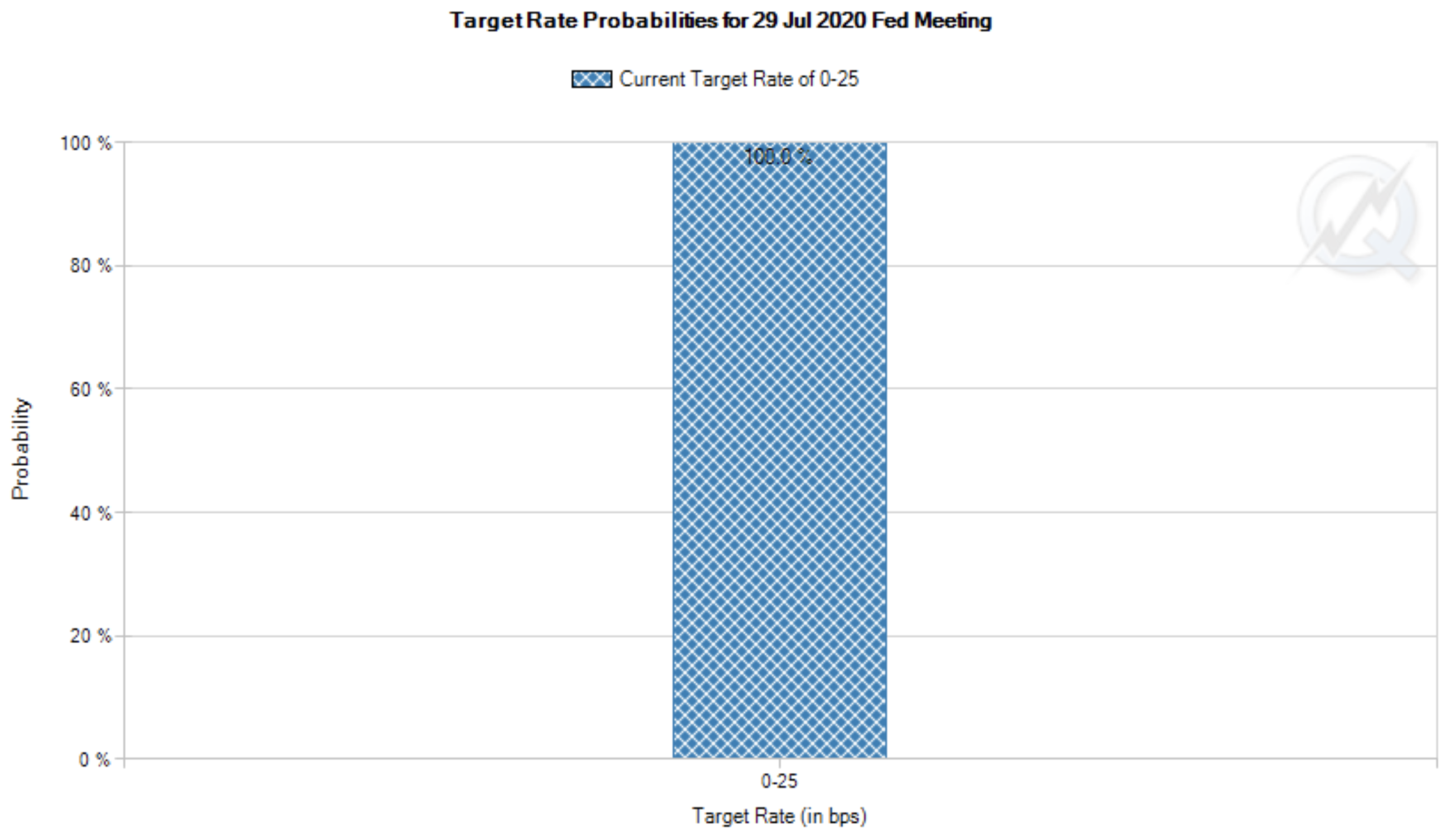

Besides raising the federal funds rate the Fed also is expected to announce its. Web Mortgage rates could surprise us this week Borrowers and experts alike have been eyeing this weeks Federal Reserve meeting as a key moment for mortgage rates. Web The bond market was more interested in the assertion from Fed Chair Powell that the committee isnt even considering raising rates by more than 050 at any.

Web Mortgage rates have increased a little this week but you dont need to worry about rates skyrocketing. The average rate applied to a thirty. Lock Your Rate Today.

Find A Lender That Offers Great Service. Web The average rate on the 30-year mortgage was 389 in February 2022 the month before the Feds first rate hike. Web 1 day agoAfter a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022.

Web The US inflation rate rose 64 on an annualized basis in January. Web The average contract rate on a 30-year fixed-rate mortgage jumped by 23 basis points to 662 for the week ended Feb. Ad Mortgage Rates Are Constantly Changing.

Web Last fall mortgage rates dropped dramatically and by February of this year the average rate on the 30-year fixed was at 275. Get Preapproved By a Lender You Could Save. Comparisons Trusted by 55000000.

Web The housing market is one of the sectors most impacted by the Federal Reserves decision to rapidly increase interest rates. Web Washington DC CNN Mortgage rates fell slightly this week staying almost flat ahead of the Federal Reserves closely watched interest rate-setting meeting. Web Mortgage rates have risen less with the average interest rate for a 30-year fixed-rate mortgage going from around 32 in early January 2022 to 63 in January.

Web Here are the current mortgage rates without discount points unless otherwise noted as of Feb. Web Utah Mortgage and Refinance Rates. The Federal Reserve met April 27 and 28 and agreed to keep.

Web Graph and download economic data for All-Transactions House Price Index for Salt Lake City UT MSA ATNHPIUS41620Q from Q1 1977 to Q3 2022 about Salt. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Aiming for 15-20 percent may seem like a big difference but it makes a huge difference in the amount of money.

Web The Feds decision to raise the federal funds rate by 025 on Feb. It rose above 7 in October and November. No application processing or underwriting fees.

Get Instantly Matched With Your Ideal Mortgage Lender. On Saturday February 25 2023 the national average 30-year fixed mortgage APR is 704. Get Preapproved By a Lender You Could Save.

645 down from 649 a week ago. Officials voted at the meeting to raise the benchmark interest rate a quarter percentage point to a range of 45 to 475 and.

What The Fed S New Economic Policy Means For Mortgage Rates Fox Business

Mortgage Rates Resume Upward Trek Ahead Of Next Week S Fed Meeting

The Fed May Give Trump His Rate Cut The Question Is When The New York Times

Mortgage Rates On The Rise In Advance Of Fed Meeting Themreport Com

Fed Set To Raise Rates But Will Mortgage Rates Follow Bankrate

A Looming Wheat Crisis Next Door Br Research Business Recorder

Leveraged Loans In A Rising Rate Environment Carry Factor Dominates Indexology Blog S P Dow Jones Indices

Why You Should Lock In A Mortgage Rate Ahead Of The Next Fed Meeting Rismedia

Fed Takes Aggressive Action In Inflation Fight The New York Times

Fed Slashes Rates To Near Zero And Unveils Sweeping Program To Aid Economy The New York Times

Lock In Your Mortgage Rate Now To Take Advantage Of Low Rates Before The Fed Meets Bankrate

Mortgage Rates And The Fed Funds Rate Updated 2023

How To Enjoy Your Life After The Fed Ruins The World

How To Enjoy Your Life After The Fed Ruins The World

Will Mortgage Rates Fall Again After This Week S Fed Meeting Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Central Bank Watch Fed Speeches Interest Rate Expectations Update

The Fed Monetary Policy Monetary Policy Report